Asbury Research, a frequent contributor to Proactive Advisor Magazine, wrote the following this past weekend in its analysis of current market action:

Apple Inc. (AAPL) has a big influence over both the S&P 500 (SPX) and NASDAQ 100 (NDX) due to its huge market capitalization and tight and stable positive correlation to both major indexes. Accordingly, AAPL’s failure to rise above major overhead resistance at its November 2015 low, July 2015 downtrend line, and 200-day moving average back in mid-April, led, and helped to trigger, the April 20th peak in SPX (see chart below).

APPLE (AAPL) PRICE TREND VS. 200-DAY MOVING AVERAGE

Asbury’s analysis continued:

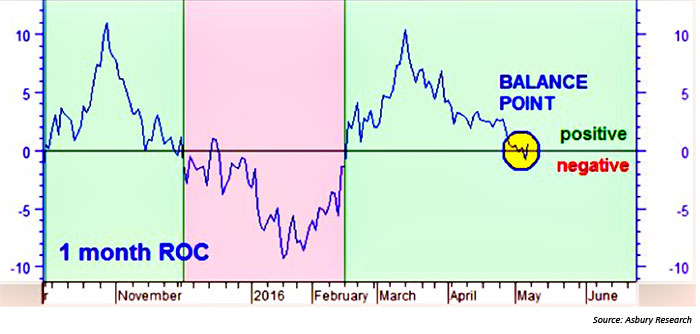

Almost a month later, the chart also shows that AAPL is currently testing its August 2015 and February 11th lows at $92.00 per share. A sustained rebound from $92.00 would suggest an emerging rebound in the broader U.S. market, while a sustained decline below it would suggest a deeper decline in SPX, the latter which would be signaled by a negative shift in its monthly rate of change (MROC). The S&P 500 monthly rate of change turned positive (bullish) on February 16th and remained so—but just barely—heading into next week (w/o 5.9.16).

S&P 500 (SPX) MONTHLY RATE OF CHANGE

Apple, of course, largely disappointed investors in its earnings report and forecast delivered on April 26. Headlines in the financial press were ominous, such as this one from Fortune: “After years of blockbuster sales, investors fear that the iPhone has reached a saturation point.”

Supporters pointed out that the iPhone 6 still generated remarkable sales, with year-ago comparisons absurdly difficult to match. Explaining the challenging high bar, Apple’s chief financial officer, Luca Maestri, said in an interview with Reuters, “The iPhone 6 is an anomaly.”

The facts remain, however: Apple sold 51.2 million iPhones in its second fiscal quarter, well down from 61.2 million in the year-ago quarter. It also missed on EPS ($1.90 vs. estimates of $2.00) and put forward a next-quarter revenue estimate of $41 to $43 billion, below the consensus of $47.3 billion. Said Reuters, “Apple posted its first-ever decline in iPhone sales and its first revenue drop in 13 years as the company credited with inventing the smartphone struggles with an increasingly saturated market.”

Apple’s stock-price slump was not helped by comments from well-known investor Carl Icahn, who announced, according to Business Insider and CNBC, that he had previously exited his position in Apple’s stock (to media speculation that he had registered a profit around $2 billion). Said Icahn, “I don’t think it’s a price point [that would get him to go back into Apple stock]. I think it’s my opinion about what is happening in China. … I think the stock is very cheap still on a multiple basis. … I got out because I’m worried about China. … I hope to get back into it one day.”

CNBC noted that while Apple itself remains “very optimistic about the China market over the long term,” Icahn’s concerns have some legitimate underpinnings:

One area of weakness for Apple in the quarter was the Greater China segment—comprising mainland China, Taiwan, and Hong Kong. Revenue for that region fell 26 percent year over year to $12.49 billion. Previously, that area had posted consistent growth for Apple.

Many Street firms lowered their upside estimates for Apple’s stock price based on earnings and the revised outlook. Said AppleInsider of Piper Jaffray, home of noted tech analyst Gene Munster, “Piper Jaffray has maintained its ‘overweight’ rating for Apple, and the company remains its top pick for investors in 2016. However, the firm did cut its price target from $172 to $153.” According to several recent interviews by CNBC with analysts, a stock price “floor” around $85-$90 is expected to hold for AAPL, but opinions are very mixed on how quickly new product rollouts will turn around sentiment on the company.