A New Year’s resolution for every investor

Understand how diversification should work.

The holiday season came and went in a blur, just as it always seems to do. But we are left with fond memories of celebration with family and friends, not to mention the many occasions for traditional Thanksgiving, Christmas, and New Year’s Eve (and Day) spreads. I don’t know about you, but our family enjoys the leftovers from each of these meals every bit as much as their first glorious serving. With all of the excess we see displayed in America, it is somehow comforting to know nothing is going to waste!

When Christ spoke the words in John 6:12, I think He had two meanings in mind. First is the obvious meaning: gather and make use of the food left over from the feeding of the 5,000. In my opinion, those fragments were a second miracle. Imagine, leftovers from the two small fish and five loaves of barley bread that fed the multitude. Somehow there were leftovers (12 baskets full), and Christ wished to make sure that they would be used to feed others.

His second meaning, I believe, was to help people in need who have been left behind, “so that nothing may be lost.” I think this sentiment is an undertone of the whole holiday season, which began with our prayers of thanks on Thanksgiving.

In the financial markets, ‘leftovers’ can also have a double meaning

On a broad level, as a contrarian, I think of “leftovers” as those asset classes that have not been feeding the latest financial “bubble.” Since the market bottomed in 2009, we know that both bond and stock investors have largely prospered. For stocks, it has been a six-year bull market. For bonds, the profits have been growing for 30 years!

Left behind through the last six years have been most other asset classes. Gold and commodities are surely in this category, as they seemed to be making new lows on a daily basis. Just check the price of gasoline at your local gas station. These and other “real” assets (for example, timber, real estate, and crops) are often referred to as alternatives when added to a portfolio. Yet, we here at Flexible Plan Investments, together with other financial firms that have joined our crusade over the last 30 years, have promoted a newer class of alternatives: alternative strategies.

Both alternative strategies and asset classes are added to a portfolio for one main reason: diversification. They are intended to add returns when stocks and bonds are not performing. (Note: While some strategies are designed to grab the majority of the returns generated from rising stock or bond markets and mitigate the downside, many other strategies are designed to prosper when stocks and bonds do not. These are true alternatives.)

One of the great discoveries in investments of the last 30 years: A portfolio is not truly diversified unless it holds alternatives—both asset classes and strategies

Some investors have a hard time living with the consequences of this simple maxim. They buy into it when a new portfolio is created for them by their financial advisor. Of course they want it to be diversified. Of course they want it to have the protection diversification historically has brought when the inevitable downturn in stocks or bonds occurs.

Yet when their first or second investment statement shows some assets or strategies experiencing losses, those same investors express concern. After a year or two, some strategies or asset classes may still be down in value, even while other parts of the portfolio are thriving. The very human tendency is to throw out the leftovers, to throw out those asset classes and strategies left behind.

Gather up the fragments left over, so that nothing may be lost.

– John 6:12

I constantly feel the need to remind these investors and their advisors of a simple truth: “If everything in your portfolio is going up, it is not diversified.” Diversification comes from having investments that perform differently. Differently includes going in opposite directions. To actually diversify a portfolio against the ever-present risk of an unexpected change in the current financial conditions, the behavior of the portfolio’s investments must not be fully correlated.

Warren Buffet is considered to be one of history’s great investors. He espouses value investing. Value investing is based on the premise that one buys investments that are cheap and out of favor in order to benefit from their subsequent recovery. Portfolio creation is based on this same premise. You hold assets that are out of favor, even in a market where other aspects of the portfolio are flourishing, because the tables may, or should I say will, turn someday.

For many years, one of the alternatives used has been bonds. They are an alternative to a 100% stock investment. If one reviews the market crashes that began in 2000 and 2007, bonds performed their role as an alternative very well. Even when they were only a small part of the portfolio, they reduced the massive losses incurred by stocks. They did this because they moved in the opposite direction.

Bonds can continue to perform this function. After all, most experts have thought interest rates would rise and bond prices would fall (that’s how it works, folks) for many years, yet rates have trended lower and bond prices have risen. Someday these experts will be right—rates will rise and prices will fall. When that occurs, they will not provide the traditional protection that bonds have brought to portfolios during the last 30 years.

The role of alternative investments

Something else had better be there to help investors when both the stocks and bonds in their portfolio are tumbling in price. The something else will likely be alternative investments. While I expect that “real” asset classes (such as gold and real estate) will take on some of this role, I think alternative strategies will likely provide a more reliable source of low-correlation performance. They are actively managed, can move to the defensive asset classes that are performing well, and can often invest in funds that move in the opposite direction of stocks or bonds (inverse or short vehicles).

To the extent that these asset classes or strategies have been left behind, these financial leftovers may feed investors who have kept them in their portfolios long after the banquet in some asset classes has ended.

I see a second type of investment leftover every day in reviewing the portfolios of strategies chosen by clients and financial advisors. They pick the popular strategies and leave behind others that they may not have been exposed to during the building process. Several of these strategies are time-tested and have been around for decades, while others are relatively new. They are largely tactical in nature and momentum-based, with an eye to providing a further dimension of diversification.

I recently examined two of these strategies in particular, and they are an interesting pair. They tend to move in opposite directions. Yet they both can go long and short. They each can employ leverage. So, when one is on the wrong side of a trade, if the other is leveraged in the other direction, the entire portfolio can still make a profit.

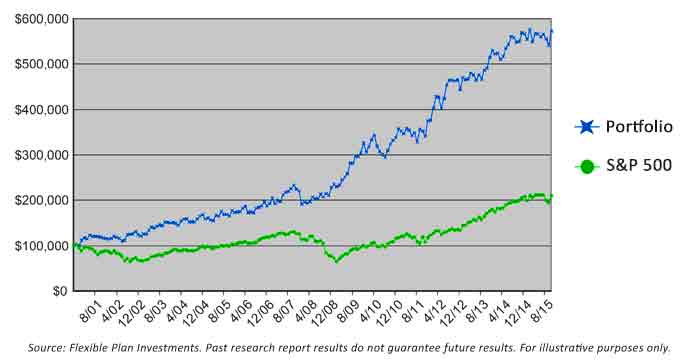

LOWER-CORRELATION STRATEGIES WORKING IN COMBINATION

During periods when the market has had low volatility, one of these strategies has been one of our top performers. Conversely, when we are in periods of high volatility, the other trend-following strategy soared while the first strategy underperformed. I put the hypothetical research reports for both together in our illustration generator (50% invested in each).

Not bad for a couple of leftovers! But here is the important point: Strategies that have periods of underperformance are often overlooked, or abandoned too early, by many advisors and investors. In fact, when used in proper combinations as part of an overall diversified portfolio, they can add counterbalancing performance and risk-management benefits over full market cycles.

I hope you enjoyed this past holiday season as much as I did and were able to avoid some of the excesses that tend to accompany celebrations. It is never too late for a New Year’s resolution; perhaps you can join me in embracing the leftovers, whether they are in your investment portfolio or in society as a whole. By doing so, we can seek a common goal—“so that nothing may be lost.”

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI was named to the 2015 Financial Times 300 Top Advisers and the 2015 Inc. 5000 List of fastest-growing private U.S. companies. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI was named to the 2015 Financial Times 300 Top Advisers and the 2015 Inc. 5000 List of fastest-growing private U.S. companies. flexibleplan.com