Active management reflects market reality

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

– William Arthur Ward

To be a buy-and-hold investor, one must be an optimist, trusting in the market’s upward direction and confident that, should there be a downturn, the recovery will be swift. While the active manager may believe in the long-term upward trend of the market, that belief is tempered by reality.

The history of the financial markets is a tale of one financial meltdown after another, progressively becoming more expensive and damaging. It’s easy to overlook how frequently these crises occur because their impacts are not always at the bear market level. But they still inflict extensive loss to investment portfolios, financial institutions, and governments.

From 1950 to 1994, market historians can count at least 11 significant market “events,” beginning with the 1958 bond-carry trade collapse and ending with the Mexican debt crisis of 1994 (with the painful crash of ‘87 thrown in for good measure). Figure 1 highlights significant market disruptions since 1994.

FIGURE 1: S&P 500 PERFORMANCE VS. MARKET EVENTS

“Financial markets are the machines in which much of human welfare is decided; yet we know more about how our car engines work than about how our global financial system functions. We lurch from crisis to crisis.”

— The (Mis)Behavior of Markets, Benoît Mandelbrot

“We lurch from crisis to crisis.” For mathematician Benoît Mandelbrot, this was the sorrow of the financial world. Mandelbrot worked for IBM for 35 years, giving him access to the latest and most powerful computers. Working with computer graphics to create and display fractal geometric images, Mandelbrot may have been the closest yet to mathematically modeling financial markets. But his efforts reinforce the reality that financial crises are the norm—not the exception.

Hyman Minsky, the mid-20th-century economist, also concluded that financial systems are inherently susceptible to bouts of speculation that, if they last long enough, end in crises. Rather than being models of efficiency, he maintained that financial markets have a tendency toward excess and upheaval.

Justin Lahart of The Wall Street Journal has an excellent, plain-English summary of Minsky’s views:

“At its core, the Minsky view was straightforward: When times are good, investors take on risk; the longer times stay good, the more risk they take on, until they’ve taken on too much. Eventually, they reach a point where the cash generated by their assets no longer is sufficient to pay off the mountains of debt they took on to acquire them. ‘This is likely to lead to a collapse of asset values,’ Mr. Minsky wrote. When investors are forced to sell even their less-speculative positions to make good on their loans, markets spiral lower and create a severe demand for cash. At that point, the ‘Minsky moment’ has arrived.”

On a far more recent note, in September 2013, even the president of the Federal Reserve Bank of San Francisco, John C. Williams, commented, “Asset price bubbles and crashes are here to stay. They appear to be a consequence of human nature.”

If one is to balance optimism with realism, active management becomes a crucial element of a prudent investment approach. Equity investments as an asset class have historically provided the greatest return—but at considerable volatility. This volatility often leads investors to buy stocks at market highs and sell at market lows, failing to realize much of the market’s power to create value. Managing volatility through active management helps investors stay the course.

Active management enables investing more aggressively in favorable market conditions and taking less risk in uncertain markets.

Equally important, active management has the potential to improve long-term investment results. By managing risk, active investment approaches enable investors to take a more aggressive approach to the financial markets by adjusting equity exposure in response to market trends. In a rising market trend, the portfolio may be 100% invested in equities (or more) to benefit from the market’s momentum, and vice versa in a down market. In comparison, the traditional approach of using a fixed allocation among non- or low-correlation asset classes to manage risk ensures that a significant portion of the portfolio is always underperforming, depressing overall returns.

Any time investors can avoid losses, they gain leverage to benefit from bull markets. It comes back to the mathematics of losses and gains. It doesn’t take a 50% gain to recover from a 50% loss—it takes a 100% gain. If an investment strategy can reduce the market’s occasional 30%-50% loss to a portfolio loss of 10% or less, then compounded returns can build significantly over time versus a buy-and-hold approach.

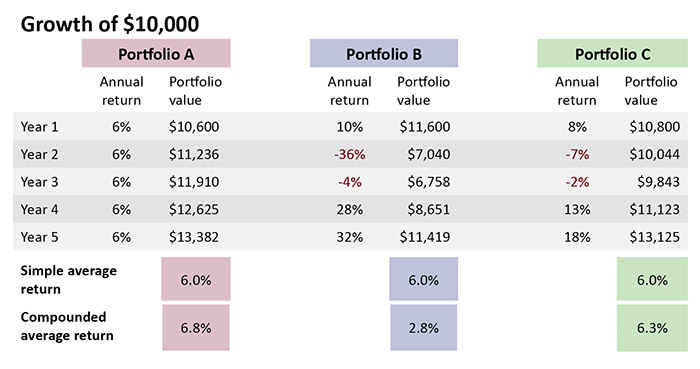

It is troubling how often studies of market behavior use “average” annual returns to compare the performance of investment approaches, ignoring what financial author Hans Wagner has called “the dark side of compounding.” Wagner explains, “In the final analysis, one cannot spend average returns, one can only spend compounded returns.” As Figure 2 indicates, “slow and steady” return performance that avoids the impact of steep losses can lead to higher compounded returns over time.

FIGURE 2: THE IMPACT OF RETURN DISPERSION

Active management enables the investment advisor (and his or her clients) to invest more aggressively in favorable market conditions and take less risk in uncertain market environments, in effect smoothing a portfolio’s growth trend and gaining the potential to outperform buy-and-hold investors over the long run. This requires identifying and taking advantage of market trends and implementing risk-management strategies to blunt the effects of the negative return scenarios. While hardly an easy challenge, the success of established active managers over the last 30 years has proven active management’s viability.

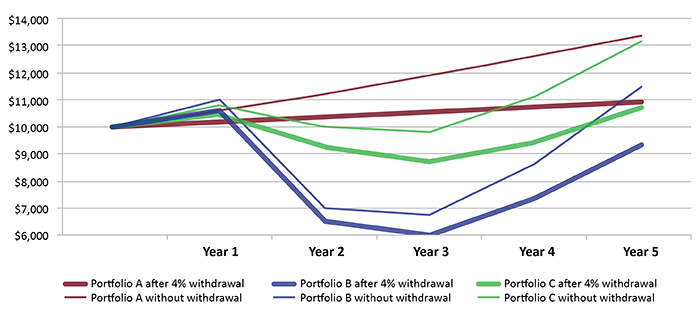

Active management becomes particularly important as individuals enter retirement and begin withdrawing funds to meet expenses. In Figure 3, Portfolios A, B, and C are shown with and without an annual withdrawal rate of 4% in retirement. Steady withdrawals dramatically impact Portfolio B’s ability to recover from two down years (despite its two big winning years), while Portfolio C, which had less severe drawdowns, nears the value of the steady-return Portfolio A.

FIGURE 3: COMPARISON OF PORTFOLIOS A, B, AND C

With and without 4% annual withdrawals

The blind optimism of a buy-and-hold approach ignores the fact that history tells us that it is prudent and logical to expect negative market events to occur in the future, just as they always have. Active management cannot necessarily guarantee results, but it accepts this reality and moves away from unmanaged risk. And that is essential in a world where the future is unknown.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com