10 reasons investors need active management in retirement

Without employment earnings to offset portfolio losses, protecting portfolio value is essential for retirees. Traditional investment strategies often fail to do so.

1. The traditional age-adjusted portfolio isn’t working

Traditional asset allocation maintains that as individuals age and approach retirement, their investment portfolios need to reduce exposure to high-risk assets and focus on capital preservation through investments such as more conservative bonds. A typical portfolio recommendation for an investor over the age of 55 might look like this:

TYPICAL PORTFOLIO ALLOCATION FOR INVESTORS OVER 55

Based on the Barclays U.S. Aggregate Bond Index, this pegs the majority of the portfolio at approximately a 2.1% annual yield, just below recent inflation estimates for the Consumer Price Index (CPI) around 2.2%. Add in taxes, and the equity and real estate portions of the portfolio have to provide substantial outperformance to offset both the loss in buying power of a bond-heavy portfolio and to provide real returns.

2. Bond risk is greatly underestimated

There can be no guarantee that a high bond allocation will preserve the value of the portfolio. Bonds face many of the same risks as equity investments, including the financial health of the issuer—default risk—and market risk. But they are particularly vulnerable to interest-rate and inflation risks. Since bonds typically offer a fixed interest rate (TIPs are one exception), increases in market interest rates lower the value of the bond, while increased inflation will whittle away the value of the return.

3. Traditional age-adjusted portfolios lack an inflation hedge

Inflation has been remarkably mild in recent years, but there is no guarantee it will continue at or below 2%. The U.S. money supply, as measured by M1, has increased since the credit crisis, generally outpacing domestic economic growth. Through the increased money supply, the Federal Reserve has deliberately sought increased inflation. At some point their wish will be more fully granted. The maturity value of a $20,000 bond investment 10 years in the future is still $20,000 regardless of whether or not it will buy an equivalent amount of goods or services.

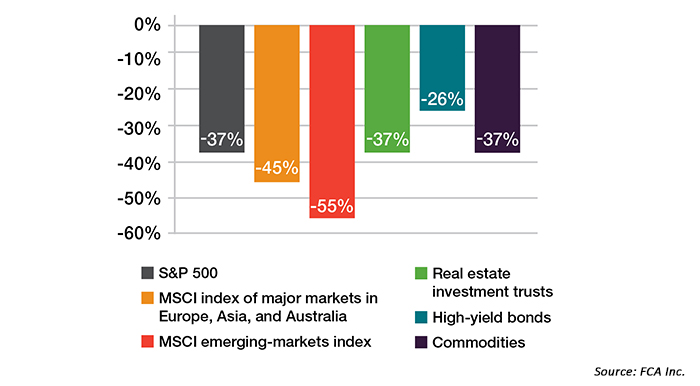

4. Correlations break down in severe market declines

Traditional market theory maintains that bond values and stock prices are uncorrelated—they move in opposing directions. When stocks decline, bonds should increase in value, maintaining the overall value of a diversified portfolio. Studies have shown that in times of market uncertainty, relationships tend to break down with higher-risk bonds most vulnerable to losses. In the 2007–2009 market decline, asset classes became more correlated, moving down together.

ASSET CLASS MOVEMENT (2007–2008)

5. Retirees need equities for higher returns, but may not have time to recover from a severe bear market

Buy-and-hold investment approaches rely on the market’s long-term upward bias to recover from a bear market. But the recovery is neither guaranteed nor predictable. It took close to five years for most major market indexes to recover from the 2000–2002 market decline and over three years to recover from 2008–2009’s worst levels. History shows that, on average, a new bear market begins every 5.5 years, with an average duration of 18.1 months. Omitting the distortion of the 1929 crash, the average time lost making up bear markets is 3.6 years. And that calculation merely measures the time spent for indexes to return to breakeven from the lowest point in a bear market—recapturing past market highs can often take even longer.

6. Active management offers more effective risk management than a bond-centric approach

The difficulty with using bonds for risk management is that investors forego the opportunity to participate in equity-market gains while remaining vulnerable to bond-market losses. 2013 was a good example of bond-market risk. The average core bond fund (at least 85% of assets in investment-grade bonds) fell 2% in 2013, including reinvested interest. The S&P 500 Index gained 31.9%, including reinvested dividends. The challenge is to capture equity performance for a retiree’s portfolio, but without the potential for losses such as the 37% loss that the S&P 500 experienced in 2008. Active management, with its focus on minimizing losses and participating in the majority of the market’s trend, is one approach to do so. Active management also has the potential to reduce the risk of bond investments, with the ability to utilize long/short bond funds and other tactics.

7. Active management doesn’t have to be perfect to work

The common criticism of active management is the statement that no one has ever been able to perfectly predict the market. But active management isn’t based on predictions, and doesn’t have to be perfect to work. The reason is the mathematics of gains and losses. It doesn’t take a 37% gain to recover from a 37% loss. It takes a 59% gain. Reduce the loss and an investor increases the leverage on the upside. With its goal of avoiding the majority of the market’s losses and capturing the majority of gains, active management can benefit from the leverage of having more capital to invest when the market cycle turns positive again.

8. There’s more than one way to actively manage a portfolio

Active management encompasses a wide spectrum of investment strategies and approaches. As the availability of data, computing power, investment alternatives, and market intelligence expands, so, too, do the active management capabilities. The right approach is the one that makes sense for the investor and the manager. Often that means a quite diverse blend of strategies and asset classes, all of which can benefit under the active management umbrella.

9. Active management accommodates behavioral finance biases

Faced with market declines or market gains, people tend to approach investing in predictable—although not necessarily logical—ways. These reactions tend to be counterproductive to long-term portfolio growth, and it is well-documented how individual investors have historically underperformed broad market indexes when left to their own emotion-driven decisions. Active management adds discipline, through professional money management, to the equation, resulting in the increased peace of mind so important to retirees. And this can benefit both advisors and their retired clients, with active management’s smoothing of returns over time facilitating the decision by clients to participate in the equity markets.

10. Market bubbles are inevitable

Exploiting their opportunity and limiting their damage requires active management. When it comes to pursuing exceptional portfolio gains, there’s nothing better than a good market bubble. But what goes up inevitably comes down. One of the best quotes on that topic comes from market analyst John Mauldin, credited to one of his mentors: “Mr. Market is a vicious sadist. He will do whatever it takes to create the greatest amount of pain for the largest number of investors.” Active management is a tool for participating in the “bubble” with eyes wide open, while always keeping one eye on the exit door.

Conclusion

It’s hard to calculate how long today’s retirees might live, but the one thing they want to know is that their money will not run out before they do. Answering in the affirmative requires combining capital preservation with the opportunity for capital appreciation. While no investor or investment management style can predict the future, everyone requires the flexibility to respond to opportunity. Active management can offer that opportunity.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com