Active management for the mass affluent

Active management for the mass affluent

Bringing dynamic, risk-managed strategies to all clients.

There is a misconception among some financial advisors that active risk management should be reserved for only the wealthiest of clients.

Not so. A growing number of financial advisors say they are finding a wealth of opportunity in helping the mass affluent actively manage their investments, as more modest portfolios can have an even greater need for the most sophisticated risk-managed strategies than those with seven figures. And just like Walmart or McDonald’s, serving volumes of customers can quickly add up—one financial advisor brought in over $1 million of assets in a month from accounts under $50,000.

Today, more financial advisors think it makes great sense to not just focus on serving the relatively narrow universe of high-net-worth clients when there are millions of potential customers needing their expert services and those of third-party active managers. Indeed, 40 million people in the U.S. have assets of $100,000 to $1 million outside of the value of their home, according to Forrester Research.

And many within the mass affluent sector now value the expertise of a financial advisor more than ever, considering that millions suffered major losses due to the recent financial crisis. Indeed, many potential clients have become much more risk-averse in their subsequent investment decisions. And though many “buy-and-holders” have since recovered their losses, many exited the markets at the worst possible time and have yet to return.

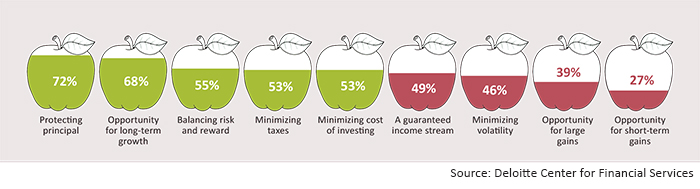

A study by consulting firm Deloitte LLP notes the post-2008 increase in risk-averse behavior on the part of the mass affluent segment. According to the data, these types of investors are twice as likely to rank themselves as “very or somewhat conservative” since the financial crisis. As the chart shows, “protecting principal” is the most highly-rated investment attribute they seek, closely followed by “long-term growth.”

RESPONDENTS RATED THE FOLLOWING “EXTREMELY/VERY IMPORTANT”

Since long-term asset growth is so important for the mass affluent as they enter or plan for retirement, there is clear opportunity for financial advisors to help find the appropriate balance of risk and return. That’s where financial advisors who use actively managed and risk-mitigating strategies might find a significant competitive advantage.

Active management relies heavily on risk-management principles, offering a potential solution to the “market fear” still prevalent for many mass affluent investors. Active management seeks favorable risk-adjusted returns in any market environment, generally employing sophisticated algorithms and models to capture gains and protect against losses in a wide variety of sectors and asset classes.

People who are less affluent actually have less wiggle room for losses within their retirement portfolios and, as such, a much greater need for active risk management by their financial advisors. For example, a retired ultra-wealthy client with a multi-million-dollar portfolio could likely better absorb a 30% hit to his or her portfolio and corresponding annual income than could a mass affluent investor taking the same percentage hit on his or her more modest retirement assets and associated income stream.

Mass affluent investors might also need the expertise of a financial advisor who practices active risk management to help them get out of their “comfort zone”—so they can make the kinds of decisions necessary to have optimal risk-adjusted returns on their portfolios. According to well-known psychologist and consultant Alasdair White, the concept of a comfort zone is “a behavioral state within which a person operates in an anxiety-neutral condition, using a limited set of behaviors to deliver a steady level of performance, usually without a sense of risk.”

In other words, to avoid anxiety, many mass affluent investors remain in comfort zones by making one of two equally poor choices: (a) traditional buy-and-hold portfolio-management strategies—even when such strategies came back to bite them when the financial crisis hit, or (b) avoiding equity markets altogether and instead investing in asset classes delivering low returns in today’s low interest-rate environment.

However, a financial advisor who uses active risk-management strategies can demonstrate the wisdom of breaking out of such comfort zones, so that mass affluent portfolios can deliver a fair share of equity market returns, while being extremely mindful of current market conditions.

An advisor can coach such investors that it is OK to feel a certain level of anxiety when stretching one’s perceptions—in fact, such a feeling can be the “optimal anxiety” experienced when one truly begins to grow. To greatly simplify, behavioral psychology encourages the conquering of fears and those who seek to take sensible control in situations full of unknowns.

Financial advisors who practice active risk management have the expertise to explain to clients the balancing act of risk and return. For most mass affluent investors, such a balancing act is even more critical as they typically have a myriad of specific goals that can each carry specific risk characteristics and time frames.

For example, many within the mass affluent sector seek expertise on how to best invest for their children’s college education, save for an eventual retirement home purchase, or manage their retirement income so they won’t outlive it. Since meeting these specific life event goals can result in differing time horizons for investment risk, active management can simultaneously handle the multiple horizons, and then tailor the strategy even further to satisfy the investor’s comfort with risk and appetite for growth.

It is not unreasonable to suggest that mass affluent investors—more than the ultra wealthy—fundamentally need the expertise of active risk management to meet such life event goals, because “the rich” simply have less concern on whether they can afford such things—they already have the wherewithal for such life events.

To avoid anxiety, many mass affluent investors remain in comfort zones by making one of two equally poor choices.

Many financial advisors have also found that serving the mass affluent can be just as—if not more—profitable than strictly serving the wealthy.

Take advisor Scott Hanson, who wrote about this topic in a 2013 Investment News article. Since his Sacramento, California, firm uses a sliding-scale fee structure based on the level of client assets, fees on smaller accounts are higher as a percentage of assets than fees on larger accounts. Hence, serving volumes of clients with smaller portfolios can add up.

“As an advisor, I would rather have a hundred $1 million accounts rather than five $20 million accounts,” Hanson writes. “The revenue generated on those 100 mass affluent clients would be much greater than the revenue generated by the five ultra-wealthy clients.”

Not all financial advisors may see it this way, but it is clear that expanding one’s practice to further serve the mass affluent could very likely strengthen the bottom line, as millions more potential clients need to be helped. A recent Wall Street Journal article cites research by Cerulli Associates, showing only 15% of U.S. financial advisors focus on households with $100,000 or less in assets.

Those advisors using active risk management principles may well have a competitive advantage with such prospects (or those with assets somewhat higher), as investors with more modest portfolios arguably have much more at stake when fulfilling their lifelong goals.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.