Everyone knows that. Just like everyone knows Pinocchio is a bad motivational speaker and Kenny Rogers is a pain to play cards with. However, when a market starts going down, many people reason why it shouldn’t. Unfortunately, unless you’re Bill Clinton, what is, is.

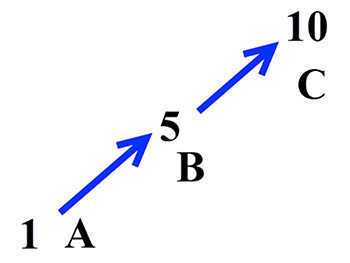

If a market is going from A to C, and B is in between, it will have to pass through B on its way to C (see figure). There are no hard-and-fast rules when it comes to fundamentals. Although, trading can be a little more difficult that simply “buying at B” (although I do have a “Buy at B” IPO strategy), you’ll do much better seeking to do just that rather than fighting a trend. (Read some of my thinking on trading IPOs here.)

Indicators are derived from price. Therefore, they are not predictive. They simply illustrate what’s already there in price. Yes, I do occasionally use moving averages with my “Landry Bowtie pattern,” but that just helps to alert me to what price is doing. Always look at price first. Use indicators sparingly and, again, as “illustrators.”

We’ve been mostly short in 2016 because the market has been headed lower. And so far, the Zika virus, bad earnings, and other negative surprises have helped our positons along. Of course, this isn’t always the case, but surprises do tend to happen in the direction of the trend.

The secret to trading is patience. Great trends don’t come along every day. You print money for a while but go back to grinding it out all too soon. They’re streaky. I was once criticized for using that word in a speech because it made trend trading sound “too elusive.” Unfortunately, it is. And, as I said in my book “The Layman’s Guide to Trading Stocks,” “you must be present to win.”

On his blog, Trend Following, author Michael Covel once equated riding a trend to riding a bouncing bronco. Big contra-trend moves often occur to shake you out, and then the trend promptly resumes. We can actually use this propensity to our advantage—looking to get in after a pullback or, as I describe in my book, a “Trend Knockout.”

The future is uncertain. We don’t know when there will be a trend. As trend followers, we wait for one to follow. We don’t know when the trend will end. Again, we just follow along. Although I’m slotted as a swing trader, on every position I hope to stay with a portion of it for at least ten years, hopefully longer.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on March 10, 2016, Volume 9, Issue 9. Some content has been updated to reflect the most current data.

Dave Landry has been trading the markets since the early 1990s and is the author of three books on trading. He founded Sentive Trading LLC in 1995 and since then has been providing ongoing consulting and education on market technicals. He is a member of the American Association of Professional Technical Analysts and was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. davelandry.com

Dave Landry has been trading the markets since the early 1990s and is the author of three books on trading. He founded Sentive Trading LLC in 1995 and since then has been providing ongoing consulting and education on market technicals. He is a member of the American Association of Professional Technical Analysts and was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. davelandry.com